As a world technological innovation platform, Intuit's eyesight is to build the entire world’s biggest Qualified community that provides tax, bookkeeping, and money specialists assurance and empowers them with clever equipment and progress paths to offer an Excellent encounter to our clients and make them productive within their money lives.

In case your tax refund quantities are insufficient to pay Anything you owe on your own mortgage, you won't be necessary to repay any remaining harmony. Even so, you might be contacted to remind you from the remaining equilibrium and supply payment instructions to you if you decide on to repay that stability.

Penalties might be imposed in the federal and state amounts for late submitting or non-filing of corporate revenue tax returns.[86] Also, other considerable penalties may perhaps utilize with regard to failures connected with returns and tax return computations.

Are guilty of breach of contract, which takes place when knowledgeable won't fulfill their obligations According to the arrangement

In addition they received’t check with you to purchase any merchandise or solutions (by way of example, marketing rebates) in Trade to get a absolutely free federal tax return.

To become a full member of AICPA, the applicant have to keep a sound CPA certificate or license from a minimum of among the list of fifty-5 U.S. point out/territory boards of accountancy; some further specifications implement.

Deferring profits: Enterprises can lessen their tax liability by deferring earnings to a future tax calendar year. This system is effective well when a corporation expects to generally be in the decrease tax bracket in the future. This system will work properly as a way to defer shelling out corporate taxes Sooner or later.

Corporate tax is imposed in The us with the federal, most condition, plus some community levels to the income of entities taken care of for tax uses as organizations. Considering that January 1, 2018, the nominal federal corporate tax charge in The us of The united states is a flat 21% following the passage of the Tax Cuts and Positions Act of 2017. Point out and native taxes and regulations vary by jurisdiction, though Most are determined by federal ideas and definitions.

Fastest Refund Attainable: Obtain your tax refund through the IRS as rapidly as you possibly can by e-submitting and choosing to get your refund by immediate deposit. Tax refund time frames will fluctuate. The IRS issues greater than nine outside of 10 refunds in a lot less than 21 days.

Undertaking attestation products and services under an unlicensed/unregistered CPA firm or below a CPA company permit which has expired.

Even further, most states deny tax exemption for interest money that may be tax exempt on the federal stage. CIT rates range from 1% to twelve%, various For each condition. The Accounting most common federal taxable income is based on apportionment formulae. Condition and municipal taxes are deductible bills for federal money tax purposes.[12]

Taxable cash flow may well vary from e book profits both of those regarding timing of cash flow and tax deductions and as to what is taxable. The corporate Substitute Bare minimum Tax was also eliminated from the 2017 reform, but some states have option taxes. Like individuals, corporations will have to file tax returns on a yearly basis. They need to make quarterly approximated tax payments. Groups of corporations controlled by precisely the same homeowners might file a consolidated return.

We offer buyer tax preparation computer software for federal and state income tax filings. No matter if you do have a straightforward filing or a posh just one, we will help you get it completed promptly and properly.

Filing electronically helps you to help save time, reduce faults, offers a safer system all while assisting to cut down paper usage as well as the affiliated carbon footprint.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Scott Baio Then & Now!

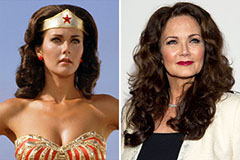

Scott Baio Then & Now! Lynda Carter Then & Now!

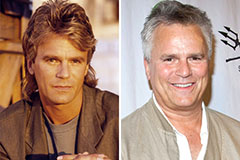

Lynda Carter Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!